Maerskin kanssa olen vähän jahkaillut ja tullut kalliiksi tänä vuonna:

Teki hyvän tuloksen ja ainoana alan yrityksistä vahtavasti voitollinen.

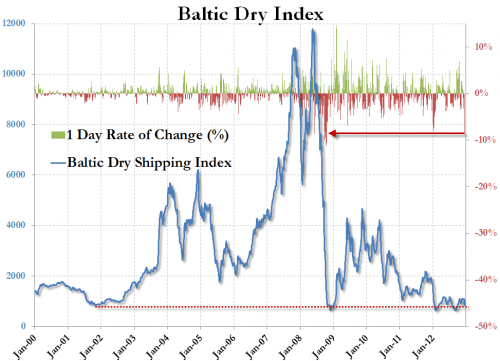

Merirahtibusiness sopii gambling-henkisille:

Nyt ollaan tosi alhaalla, mutta olennaista onkin suunta:

http://www.bloomberg.com/quote/BDIY:IND

Busineksella on erittäin suuret kiinteät kulut ja varsin volatiili palvelujen kysyntä. Tämän seurauksena tuotteen eli kuljetuspalvelun hinta liikkuu jopa 1000 %:n vaihteluvälillä lyhyen ajan sisällä (pari vuotta).

Hienoa asiassa on se, että kun kysyntä vilkastuu, eikä edes niin yllättäen, ei kapasiteetti juuri lisäänny, mutta tarve kuljettaa on melko hintariippumatonta, joten kuljettajien voitot kasvavat nopeasti astronomisesti.

Merirahti on hyvä proxy, jos haluaa betsata yleisen taloudellisen aktiivisuuden lisääntymisen puolesta maailmassa.